In today’s highly competitive business environment businesses are constantly looking for ways to cut down on risks and boost the profits. One approach that has attracted the interest by many has been ReverseRisk. This innovative strategy is rapidly changing the rules for businesses trying to limit financial risk, but be able to realize significant expansion. The article below will provide specifics about what ReverseRisk is, the way it works as well as how companies can utilize it to protect their business and to ensure that they can sustain their growth.

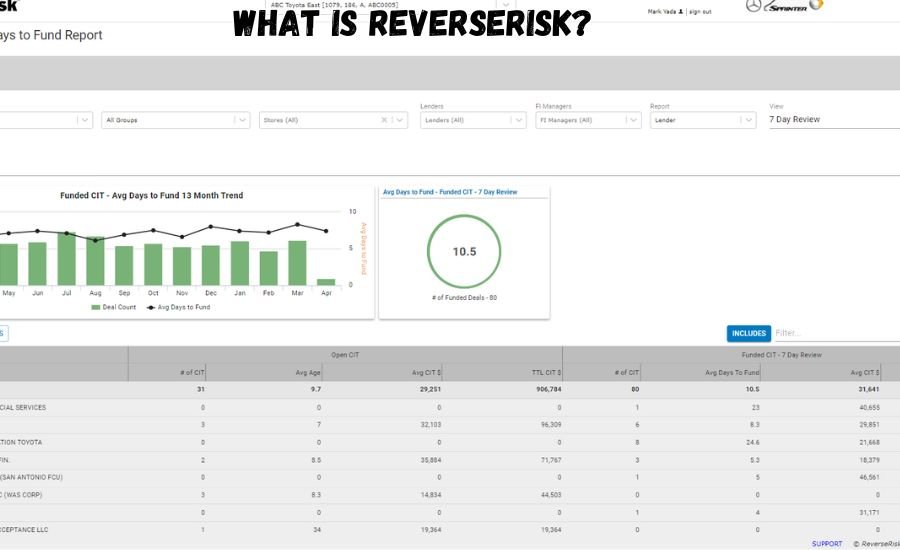

What is ReverseRisk?

ReverseRisk is an expression that focuses on identifying and reducing risk for businesses by reversing the traditional approach to managing risk. Instead of solely focusing on the reduction or avoidance of risks, Reverse Risk aims to transform risks into profitable one. This is done through innovative thinking through strategic planning using advanced methods of risk analysis.

The principle behind Reverse Risk is to understand the inherent risks that come with every business decision, but view them from a different angle. By taking sensible risks and employing the appropriate tools, companies can use Reverse Risk as a method to not only succeed, but also thrive in a highly volatile market.

How Does ReverseRisk Work?

In the simplest sense, Reverse Risk is a method to change the routine processes for managing risk. Typically, businesses focus on risk-avoidance and reducing risks as much as feasible. While this is crucial it can be the cause of missed opportunities to grow and improve.

In ReverseRisk the main focus shifts from taking care of risks to identifying opportunities in these dangers. By studying the possible benefits of taking risks, businesses are able to make more informed choices that will allow companies to stay in front of their competitors. Reverse Risk uses data analysis, trend forecasting and as a strategic plan of action to discover and exploit the potential advantages hidden in the uncertain circumstances.

The Benefits of ReverseRisk for Businesses

- Risk Mitigation by Strategic Control

A main advantage that comes with ReverseRisk is that it permits companies to take charge of risks while maintaining control over their business performance. Instead of completely avoiding risk, managers can take the risk of making decisions that are aligned with their goals. This proactive method will ensure that businesses are well-prepared for any unexpected and foreseeable issues. - Enhanced Decision Making

With the aid of Reverse Risk businesses can enhance their decision-making processes. Utilizing data analysis and predictive modeling allows companies to assess the risks and benefits more precisely. This leads to better decisions made based on solid data, not on strategies of avoidance based on fear. - Improved Financial Performance

Implementing Reverse Risk directly impacts profitability. When companies can identify lucrative opportunities in risky ventures, they’re able to develop new revenue streams and increase the profit. This strategy transforms the potential for failure into an opportunity to develop and innovate that in turn improves the profitability of the company. - Adaptability in Changing Markets

In the current dynamic market, businesses need to be able to change. Reverse Risk lets companies quickly adjust to react to market changes. With a mentality that views risks as an advantage, businesses are able to react faster to emerging trends and gain from the changes in market conditions.

features in ReverseRisk:

| Feature | Description |

| Risk Mitigation | Businesses can lower the chance of losses while retaining control over results. |

| Data-Driven Decision Making | uses predictive models along with data analytics in order to help make informed and calculated risk-taking choices. |

| Increased Profitability | Finds lucrative opportunities in risky ventures that can boost an increase in revenue as well as increase the profitability. |

| Adaptability | allows companies to quickly adjust to changes in market conditions. This makes them more flexible and adaptable. |

| Strategic Control | This helps companies have better control over their risk-taking decisions and to align these with strategic goals. |

| Innovation | Encourages innovation through taking risks, which leads to the development of innovative products or services as well as business models. |

| Comprehensive Risk Assessment | It requires a thorough analysis of risks, both internal and external. It assists businesses in identifying opportunities to grow. |

| Contingency Planning | The backup plans integrate to minimize negative consequences if risks do not produce the desired results. |

| Experts collaborate with HTML0 | Collaboration with experts in risk management and financial experts to implement ReverseRisk strategies that work efficiently. |

| Cultural Shift | Establishes a culture within the business that values measured risk-taking as a key element in the growth. |

| Market Competitiveness | Companies can keep ahead of their competitors by taking risks to increase competitive edge. |

| Predictive Trend Analysis | Utilizes forecasting tools to detect emerging trends that could be beneficial to the business. |

| Enhanced Operational Efficiency | facilitates the flow of processes through identifying areas where taking risks could result in better processes. |

| Long-Term Sustainability | Helps businesses adopt sustainable methods by the identification of long-term growth opportunities through risk-taking. |

| Financial Growth | helps in fostering financial growth by allowing businesses to invest in high-risk profitable, high-reward opportunities. |

Implementing ReverseRisk in Your Business Strategy

The implementation of ReverseRisk is not a once-only process, but if follow the right strategy companies can incorporate this strategy to improve their everyday operations. Here are the most important steps to adopting Reverse Risk effectively:

Read More: Irthamicen-unveiling-the-mystery

- Conduct Comprehensive Risk Assessments

First step in deciding to begin implementing Reverse Risk is to establish the risk your company faces. This involves the identification of risks from both sides that may affect your business’s processes. By conducting an exhaustive risk assessment you’ll be able identify areas where ReverseRisk can be utilized. - Leverage Data Analytics

Analytics based on data is a powerful instrument in the field of Reverse Risk. Utilizing the most recent analytics software companies can spot patterns and predict the outcomes that could occur. This method of data-driven decision-making allows companies to make more informed choices with greater certainty and precision. - Foster a Risk-Taking Culture

To allow ReverseRisk to succeed, it’s crucial to build an environment that’s open to innovation and risk. Encourage employees to think outside of the box and challenge the status quo. It’s an excellent way to discover opportunities for growth that previously were not considered. - Create Contingency Plans

Although Reverse Risk encourages businesses to take calculated risk, it’s essential to prepare contingency plans for the future. This will make sure that if the risk does not result the way you anticipated, your business can quickly adjust and limit the negative effects. - Collaboration with specialists

Another important aspect that is essential to Reverse Risk includes working alongside experts within the area of finance, risk management and strategic planning. Working with experts in these areas, entrepreneurs are able to gain valuable insights that will assist them in applying Reverse Risk more effectively.

ReverseRisk vs. Traditional Risk Management

The traditional approach to risk management focuses on identifying, decreasing, the risk of being exposed at any risk. While this is an essential step in keeping the stability of an organization, it could slow the growth potential and innovation. Companies that only use traditional risk management techniques could miss many lucrative opportunities because they’re too focused on decreasing risk.

On the other hand, Reverse Risk encourages companies to look at risk from a different perspective. If you consider risk more of an opportunity instead of an obstacle, companies can discover hidden value and come up with innovative ways to succeed. This innovative method allows companies to stay relevant and flourish in an ever-changing market.

Real-World Examples of ReverseRisk in Action

Numerous successful companies have embraced the idea of ReverseRisk and used the concept to increase their profits. For instance in the realm of technology, companies like Apple as well as Tesla have taken calculated risks in introducing innovative products that have revolutionized how they work. Instead of trying to limit the risks of new technologies the firms took on the risk and have turned them into huge success.

The financial sector, investing industry, they are expanding the utilization of Reverse Risk strategies to analyze the possibility of generating gains from high risk investment. Through an approach which is more analytical in its approach to risk and return, they can identify opportunities to earn huge profits even in volatile markets.

Challenges and Considerations of ReverseRisk

While ReverseRisk is a great option, it’s not without a few issues. One of the main obstacles that companies face when using this strategy is the inherent uncertainties that come with the risk. Even with the most advanced analytical tools and a comprehensive plan, there’s always an element in uncertainty. But the most effective way to deal with this problem is to develop an efficient contingency plan along with a solid risk management plan in place.

Furthermore, the adoption of Reverse Risk requires a shift in how we think. Leaders in the world of business must be able to embrace uncertainty and consider taking risks as a possibility to grow. This can be a difficult task for companies that are generally in a position of disadvantage when it comes to taking risks, however with the right guidance and encouragement, it’s possible to transition to an optimistic and risk-taking mindset.

The Future of ReverseRisk in Business

As businesses face new problems and opportunities in a changing world, ReverseRisk may become an important part of their business plan. The increased access to predictive modeling as well as data analytics tools will enhance the ability of businesses to make smart, informed decisions based on data. Businesses that are able to take on Reverse Risk are more prepared to adapt to market trends and in ensuring long-term growth.

In the final analysis, Reverse Risk is a powerful and innovative approach that allows companies to not just manage risk, but also make utilization of the concept to generate potential chances. Through a proactive approach to managing risk, companies can improve their decision-making process, increase the performance of their financial company, and stay adaptable in a dynamic marketplace. Future prospects for Reverse Risk appear promising. Businesses that use this method are likely to succeed in an in-demand market.

Conclusion

ReverseRisk is a clever method for companies to expand their business by utilizing risks in a carefully controlled manner. Instead of avoiding risk they can learn about them, learn about them and utilize them to identify opportunities to be successful. This approach helps businesses remain resilient in the face of changing markets and make better choices. With the help of data and planning ahead companies can turn risky situations into huge benefits. ReverseRisk doesn’t mean that you take risks but rather, making smart decisions that result in the success you want.

Any company, big and small can make use of ReverseRisk to expand and grow. It can help companies keep ahead of their competition and come up with innovative ways to earn profit. If they have the right plan the risk-taking process can be a potent tool for success. The trick is to remain informed and have an emergency strategy. When utilized properly, ReverseRisk can turn business problems into opportunities to expand your business.

Stay Connected With: Th3v3nusgodd3ss-ig

FAQs

What is ReverseRisk?

ReverseRisk is a strategic method for managing risk, which converts the risk into an opportunity to grow and profits. It is built on data analytics and an organized strategy to accept risk that is calculated, rather than trying to reduce them.

What is the best way to utilize ReverseRisk assist companies?

ReverseRisk assists businesses to make better decisions to boost their profit and adapt to ever-changing marketplaces. By taking risk-taking into account, entrepreneurs can capitalize on new opportunities and minimize the risk they take.

Is ReverseRisk the best choice for all kinds of businesses?

It’s the case that ReverseRisk can be a viable alternative for businesses that are of any size and in all sectors. It assists businesses in identifying opportunities in unpredictability, regardless of the industry, making it an adaptable and efficient technique.

How can businesses use ReverseRisk?

Businesses can benefit from ReverseRisk by conducting thorough risk assessments employing data analytics, instilling the mindset of taking risks and establishing plans for contingency to handle unpredictable circumstances.

What issues could companies face within the setting in the context of ReverseRisk?

The main problem with ReverseRisk is the ambiguity that is associated with taking risks. But, by using predictive modeling and having strong contingency plans, companies are able to lessen negative effects and perform more informed decisions.