Writing a check may seem like an old-fashioned way to pay for things, but it is still useful in many situations. If you have never written a check before or need a refresher, this guide will help you. In this article, we will explain how to write a check step by step. You will learn the important details you need to include to ensure your check is filled out correctly.

Why Learning How to Write a Check is Important

Many people now use digital payments, but checks are still necessary for certain payments, such as rent, utility bills, or donations. Knowing how to write a check properly can prevent mistakes, fraud, or rejected payments. Writing a check the right way also helps you maintain accurate financial records.

Understanding the Parts of a Check

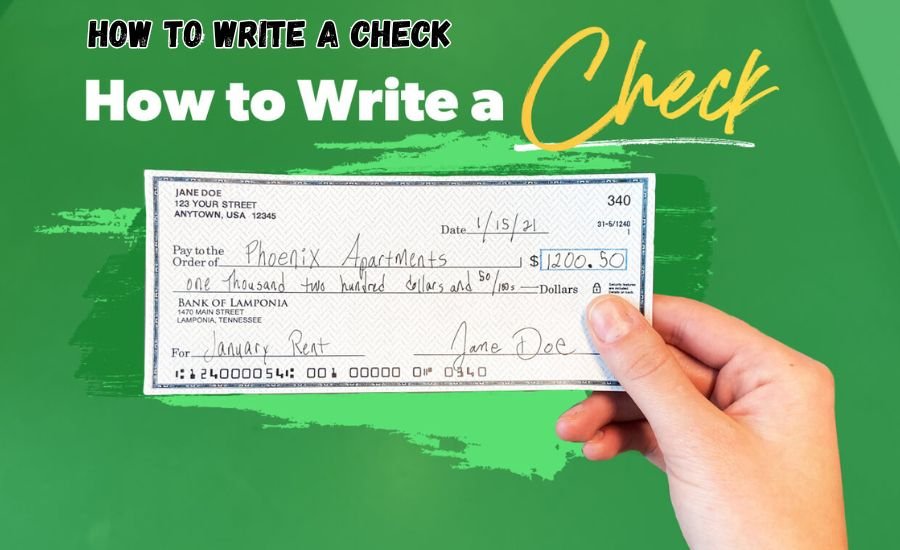

Before you learn how to write a check, it’s important to understand the different parts of a check. Each check has the following sections:

- Date – The date when the check is written.

- Payee Line – The name of the person or business receiving the payment.

- Amount in Numbers – The amount of money in numerical form.

- Amount in Words – The same amount written in words.

- Memo Line – A short note about the purpose of the payment.

- Signature Line – Your signature to approve the payment.

- Routing and Account Numbers – These numbers identify your bank.

Now that you understand these parts, let’s move on to the actual steps of how to write a check correctly.

Step-by-Step Guide on How to Write a Check

1. Write the Date

At the top right corner of the check, write the current date. This ensures the check is valid and can be processed properly.

2. Fill in the Payee’s Name

On the “Pay to the Order of” line, write the name of the person or business that will receive the check. Make sure to spell it correctly to avoid any issues.

3. Write the Payment Amount in Numbers

In the small box next to the payee line, write the exact amount of money in numbers. For example, if you are paying $150.75, write it as 150.75.

4. Write the Payment Amount in Words

On the line below the payee’s name, write the same amount in words. For example, “One hundred fifty dollars and seventy-five cents.” This prevents fraud and mistakes.

5. Fill in the Memo Line (Optional)

The memo line is optional but helpful. You can write a short note about why you are writing the check, such as “Rent for March” or “Electricity bill.”

6. Sign the Check

Finally, sign the check on the bottom right corner. Without a signature, the check is invalid.

Common Mistakes to Avoid When how to write a check

When learning how to write a check, it’s important to avoid these common mistakes:

- Forgetting the Date – A missing date can cause the check to be rejected.

- Spelling Errors – Incorrect names or amounts can lead to delays.

- Mismatch in Amounts – The numbers and words should match exactly.

- Forgetting to Sign – A check without a signature is invalid.

Avoiding these mistakes will ensure your check is processed smoothly.

How to Keep Your Checks Secure

When learning how to write a check, security is important. Here are some tips:

- Use a Pen – Always use a pen to prevent alterations.

- Keep Checks in a Safe Place – Store your checkbook securely.

- Track Your Spending – Write down check details to avoid overdrawing your account.

- Avoid Blank Checks – Never sign a blank check, as it can be misused.

Read More: Guide-whatutalkingboutwillis-com

Features for how to write a check

| Feature | Description |

| Date | Write the current date on the top right of the check. |

| Payee Name | Write the name of the person or business receiving the check. |

| Amount in Numbers | Write the payment amount in the small box in numbers. |

| Amount in Words | Write the amount in words to match the numbers. |

| Memo Line | Optional, but useful to mention the purpose of the payment. |

| Signature | Sign your check at the bottom to make it valid. |

| Bank Information | Routing and account numbers are printed on every check. |

| Security | Use a pen, store checks safely, and never leave blanks. |

| Cancellation | If needed, write “VOID” on the check and inform the bank. |

| Processing Time | Checks usually take 2-5 business days to clear. |

When Should You Use a Check?

Even though digital payments are common, there are still situations where you may need to know how to write a check:

- Paying Rent – Some landlords prefer checks.

- Government Payments – Some agencies require checks for official payments.

- Donations – Many charities accept checks.

- Payments to Small Businesses – Some businesses prefer checks over digital payments.

Understanding these situations will help you decide when to use a check instead of other payment methods.

How to Cancel a Check

Sometimes, you may need to cancel a check after writing it. If you made a mistake or need to stop a payment, follow these steps:

- Write “VOID” on the check – This prevents it from being used.

- Notify Your Bank – Contact your bank to stop the payment.

- Record the Cancellation – Keep a record of the canceled check for your records.

Knowing how to cancel a check is just as important as learning how to write a check.

How Long Does a Check Take to Clear?

After you write a check, it takes time for the payment to go through. Here’s what you need to know:

- Personal Checks – Usually take 2-5 business days to clear.

- Government Checks – Can clear within 1-2 days.

- Large Amounts – Checks over $5,000 may take longer to clear.

By knowing these timelines, you can manage your finances better.

What Happens if You Bounce a Check?

If you don’t have enough money in your account, the check may bounce. This means your bank will not process the payment. Here’s what can happen:

- Bank Fees – You may be charged an overdraft fee.

- Merchant Penalties – Businesses may charge extra for bounced checks.

- Legal Consequences – Repeated bounced checks can lead to legal trouble.

To avoid this, always make sure you have enough money before writing a check.

Benefits of Writing a Check

✔ Safe and Secure – Checks are a secure way to make payments when handled properly.

✔ Good for Large Payments – Some landlords, businesses, and government offices prefer checks over cash or digital payments.

✔ Record Keeping – Checks provide a written record of transactions, helping you track expenses easily.

✔ No Internet Needed – Unlike online payments, checks can be used anywhere, even without an internet connection.

✔ Avoid Extra Fees – Many banks and businesses do not charge extra for check payments, unlike some digital payment methods.

✔ Can Be Canceled – If a mistake is made, checks can be voided or stopped before being cashed.

✔ Accepted by Many Institutions – Checks are still widely accepted for rent, donations, and business transactions.

Digital Alternatives to Writing a Check

If you don’t want to write paper checks, there are digital options:

- Online Bill Pay – Many banks allow online check payments.

- Mobile Payment Apps – Apps like PayPal and Venmo are fast alternatives.

- Electronic Transfers – Direct bank transfers can replace checks.

However, knowing how to write a check is still a valuable skill for times when digital payments aren’t an option.

Conclusion

Writing a check is easy when you follow the right steps. First, you write the date, then the name of the person or business. After that, you write the amount in numbers and words. Don’t forget to sign the check! These small details are very important. If you make a mistake, the check might not work. Also, always use a pen so no one can change what you wrote. Keeping your checks safe is also important to stop fraud. When you know how to write a check, you can make payments safely and correctly.

Even though many people use online payments, checks are still needed in some situations. You might need a check to pay rent, give donations, or pay some bills. Knowing how to write a check helps you when online payments are not an option. It is a good skill to learn because you never know when you will need it. If you ever need to cancel a check, you should act fast and tell your bank. Now that you understand checks, you can use them with confidence. Writing a check is a simple but useful skill for everyone!

Do You Know: Betechit-com-contacts-connect-with-experts

FAQs

Can I write a check in pencil?

No, always use a pen. Pencil can be erased, which makes it easy for someone to change your check.

What happens if I make a mistake on a check?

If it’s a small mistake, write a line through it and correct it. For big mistakes, write “VOID” on the check and start a new one.

How do I cancel a check after writing it?

Write “VOID” across the check and call your bank to stop the payment before it is processed.

Can how to write a check without a date?

No, a missing date can cause problems. Always write the current date to ensure the check is valid.

How long does it take for a check to clear?

Most checks take 2-5 business days to clear, but it depends on the bank and the amount.