In the ever-evolving world of finance and investment, it’s crucial to stay informed about the latest trends and opportunities. One such opportunity that’s gained attention recently is Ulty Stock. But what exactly is Ulty ‘Stock, and how can it benefit investors? In this article, we will dive deep into the concept of Ulty ‘Stock, its advantages, and how you can leverage it for your financial growth.

What Is Ulty Stock?

Ulty Stock refers to a specialized class of stocks that have demonstrated significant growth potential in emerging markets. These stocks are often associated with innovative companies in technology, healthcare, and renewable energy sectors. Ulty ‘Stock has become a buzzword among savvy investors who are looking for the next big opportunity.

The key feature of Ulty ‘Stock is its high volatility, which means that while it may come with risks, it also offers high rewards for those who are willing to take calculated risks. Investors who focus on Ulty ‘Stock are often seeking long-term gains from companies that are still in their growth phase.

How Does Ulty Stock Differ from Other Stocks?

Ulty Stock differs from traditional stocks in a few key ways. First, it tends to be more volatile, with higher price fluctuations that can lead to both significant gains and losses. While regular stocks may show more steady growth over time, Ulty Stock offers the potential for rapid appreciation in value.

Moreover, Ulty ‘Stock companies are typically newer in their respective industries. These companies may not yet have a long track record of success, but they are often on the cutting edge of technological advancements or other innovative fields. This makes investing in Ulty ‘Stock a high-risk, high-reward strategy.

features of Ulty Stock to make it easier to understand:

| Feature | Description |

| High Growth Potential | Ulty ‘Stock companies are often in emerging sectors with the potential for rapid growth and innovation. |

| Volatility | These stocks are highly volatile, offering both significant risks and rewards for investors. |

| Innovation | Ulty Stock is often linked to companies creating disruptive technologies and groundbreaking products. |

| Emerging Markets Focus | Typically found in sectors like tech, healthcare, and renewable energy that are still developing. |

| Diversification Opportunity | It helps diversify investment portfolios, reducing reliance on traditional stocks. |

| High Risk, High Reward | Due to their volatility, Ulty Stock offers potential for higher returns, but with increased risk. |

| Newer Companies | Many of these stocks belong to companies in their early stages, which can lead to higher growth potential but also greater uncertainty. |

| Market Trends Influence | Ulty Stock often aligns with broader market shifts, such as advancements in AI or renewable energy. |

| Long-Term Investment | Successful investments typically require a long-term strategy, as Ulty Stock can take time to show returns. |

| Requires Research | Investors need to conduct thorough research into the companies and sectors before making an investment. |

| Risk Management Necessary | A solid risk management plan, including diversification and stop-loss orders, is vital for investing in Ulty Stock. |

The Benefits of Investing in Ulty Stock

Investing in Ulty Stock comes with several benefits, especially for those who are looking for exciting opportunities. Here are some reasons why Ulty Stock should be on your radar:

Read More: Central-texas-first-freeze-date-explained

- High Growth Potential

Ulty Stock companies are often in industries that have the potential for exponential growth. For example, the tech and renewable energy sectors have shown remarkable growth in recent years. If you invest in Ulty Stock early, you could be in a prime position to benefit from that growth. - Innovation and Disruption

Many companies associated with Ulty ‘Stock are innovators in their fields. They are often creating groundbreaking products and services that could disrupt traditional industries. As an investor, you get the chance to be part of these exciting changes. - Diversification

Ulty ‘Stock can be a great addition to your portfolio because it allows you to diversify your investments. By including high-growth stocks in emerging markets, you reduce your reliance on traditional investments and open up new avenues for returns. - Potential for Higher Returns

Due to their volatility, Ulty Stock investments have the potential for much higher returns compared to traditional stocks. If you pick the right companies and time your investments well, you could see impressive profits.

How to Invest in Ulty Stock?

If you’re interested in investing in Ulty ‘Stock, here are some steps to get started:

- Do Your Research

The first step in investing in Ulty Stock is to conduct thorough research. Look for companies that are operating in emerging sectors and have demonstrated strong growth potential. Pay attention to their financials, leadership, and long-term strategies. - Consider Risk Management

While Ulty Stock offers high returns, it also comes with a higher level of risk. It’s essential to have a solid risk management strategy in place. Diversify your investments, only allocate a portion of your portfolio to Ulty Stock, and set stop-loss orders to minimize potential losses. - Use a Trusted Brokerage

To invest in Ulty ‘Stock, you’ll need to open an account with a brokerage that allows you to trade stocks. Choose a reputable brokerage that offers access to emerging market stocks and provides research tools to help you make informed decisions. - Stay Updated

The world of Ulty ‘Stock can change quickly, so it’s essential to stay updated on market trends and news. Follow industry reports, read expert analysis, and keep an eye on stock performance to make timely investment decisions.

Risks Associated with Ulty Stock

As with any investment, there are risks associated with Ulty Stock. Here are some potential risks to consider:

- High Volatility

The high volatility of Ulty ‘Stock can lead to significant price swings, which may result in substantial losses if you’re not careful. Investors should be prepared for the possibility of rapid declines in stock prices. - Uncertain Future

Many companies associated with Ulty Stock are still in their early stages of development. While they may have great potential, there is no guarantee of long-term success. Be prepared for uncertainty and be cautious with your investments. - Market Trends

Ulty ‘Stock is often influenced by broader market trends and economic conditions. A downturn in the economy or a shift in consumer preferences could impact the performance of Ulty ‘Stock companies.

Tips for Successful Ulty Stock Investment

To maximize your chances of success when investing in Ulty Stock, consider these tips:

- Stay Informed

Knowledge is power when it comes to investing. Stay updated on the latest news and trends in the sectors you’re investing in. Subscribe to newsletters, follow industry blogs, and listen to expert podcasts to keep yourself informed. - Invest for the Long Term

Ulty Stock investments may take time to show significant returns. Patience is key. If you’re in it for the long haul, you’ll be better positioned to weather short-term market fluctuations and benefit from long-term growth. - Keep Your Emotions in Check

It’s easy to get emotional when your investments are fluctuating, but emotional decisions can lead to poor outcomes. Stick to your investment plan, and don’t make hasty decisions based on fear or greed. - Consult a Financial Advisor

If you’re new to investing in Ulty ‘Stock, it may be wise to consult a financial advisor. A professional can help you assess your risk tolerance and guide you in making the best investment decisions for your goals.

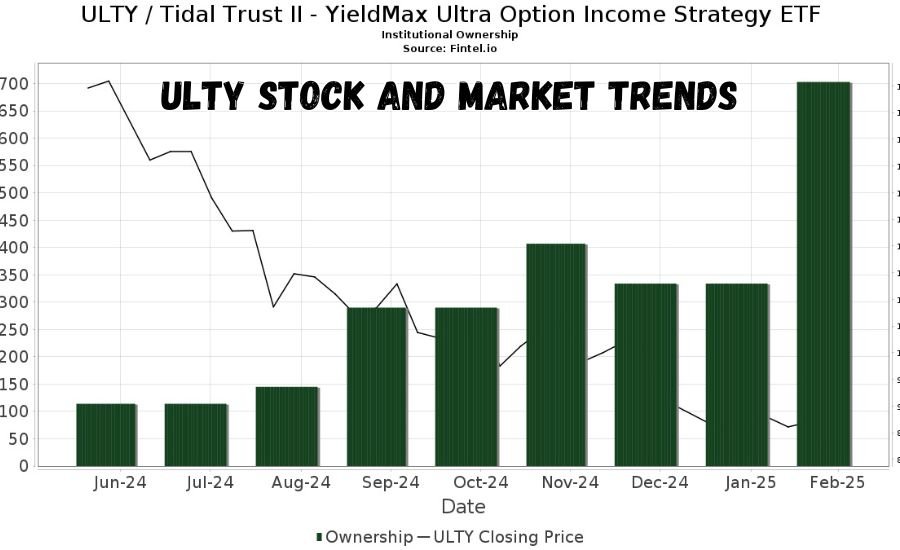

Ulty Stock and Market Trends

Ulty Stock often aligns with market trends in innovative and emerging sectors. The global shift towards renewable energy, advancements in artificial intelligence, and the rise of biotech are all trends that have fueled the growth of Ulty Stock companies. By paying attention to these trends, you can make more informed investment choices.

Conclusion

In conclusion, Ulty ‘Stock can be an exciting investment choice for people who want to grow their money fast. It’s like finding a hidden treasure because these stocks come from companies that are trying to change the world with new ideas. If you choose wisely and do your research, you could make a lot of money. But remember, it’s not always easy, and there are risks. So, it’s important to be patient and understand that the stock market can go up and down quickly.

If you decide to invest in Ulty Stock, be sure to think long-term. It might take a few years for the companies you invest in to really grow and make big changes. By keeping an eye on the market, learning about the companies, and staying calm when things get tough, you could see great rewards. Just like with any investment, it’s important to make smart choices and not rush into anything. With the right plan, Ulty Stock might just be the key to helping you reach your financial goals.

Stay Connected With: Torrentfreak-piracy-copyright

FAQs

What is Ulty Stock?

Ulty Stock refers to stocks from companies in emerging markets or industries with high growth potential, like tech, healthcare, and renewable energy. These stocks are known for their volatility, offering both high rewards and risks.

Why should I invest in Ulty Stock?

Investing in Ulty ‘Stock can provide high growth opportunities, especially in innovative sectors. If you pick the right companies, you could see significant returns over time.

Is Ulty Stock risky?

Yes, Ulty ‘Stock is considered high-risk because of its volatility. While it can offer big rewards, the prices can fluctuate quickly, leading to potential losses.

How can I start investing in Ulty Stock?

To start investing in Ulty ‘Stock, you need to research emerging companies, choose a trusted brokerage, and consider diversifying your investments to manage risks.

Can I make quick money with Ulty Stock?

It’s possible to make quick gains, but Ulty ‘Stock usually requires a long-term approach. The volatility means that prices can rise and fall fast, so patience is key for potential profits.